Institutional Investors have the opportunity to represent the capital that helps fuel moderate-income housing development. NEF's Workforce Housing Fund I is a value-add fund that targets investment opportunities in the development and acquisition of affordable rental housing. The goal is to create and preserve housing that fulfills the need for moderate-income individuals and families that struggle to find affordable housing options in neighborhoods close to job opportunities.

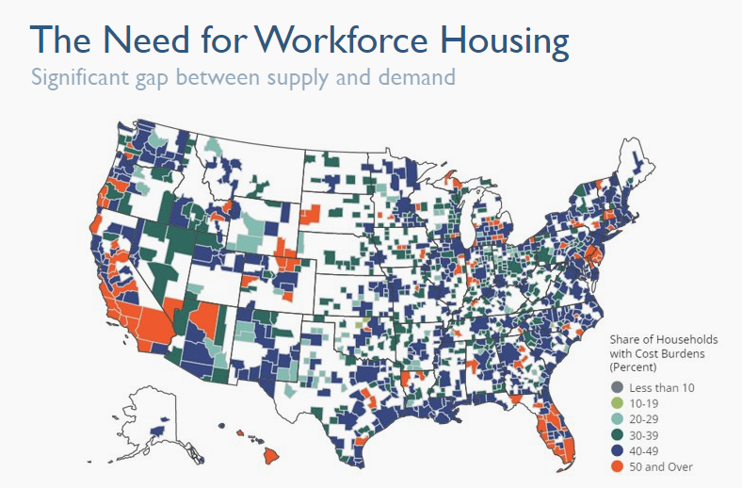

In most metropolitan areas across the country, many working individuals and families struggle to buy or rent housing in the areas in which they work. Workforce housing is largely defined as housing that is affordable to households earning incomes between 60-120% of area medium income; the renters living in this type of housing represent people seen every day, including people working in construction, retail, food service, hospitality, first responders, teachers, and healthcare workers.

Source: Harvard Joint Center for Housing Studies, Even before the pandemic, many households were burdened by housing costs, 2021, www.jchs.harvard.edu. All rights reserved.

- Select partners committed to long-term affordability.

- Focus on properties with access to job centers and transportation.

- Emphasis on healthcare services, healthy food, educational opportunities and child care.

- Workforce housing properties with equity investments between $7-30 million.

- Strong reliable developers, general contractors and property management companies.

- Metropolitan areas with positive demographics and supply-constrained markets.

- Assets may benefit from government programs providing tax abatements in exchange for long-term affordability.

- Stable Occupancy Rates

- Consistent Income Growth

- Investor Opportunities

- Diversification

Source: Harvard JCHS 2021 & 2022, Yardi, RealPage, CoStar

Mike Cathey, CFA

Managing Director, Institutional Capital Strategy

Brookshire Boulevard will offer 96 units of housing targeted to households between 80%-100% AMI. The unit mix consists of one-, two- and three-bedroom units with market rate amenities. The project is being developed by Laurel Street Residential, a minority and woman led development company based in Charlotte, NC.